The AI Investment Playbook: How Top Indian VCs Pick, Bet, and Exit

📨 Venture Unlocked | Issue #3

Welcome to this week’s Venture Unlocked Strategy deep dive — a breakdown of how top Indian VC firms are shaping the future of AI by turning conviction into capital and capital into compounding outcomes.

Context: Why This Matters

India is no longer on the sidelines of the AI revolution. From foundational LLMs to infra tooling to applied AI in logistics and compliance, we're witnessing a new wave of AI-native startups — and investors are paying attention.

But what separates an AI funder from a trend chaser?

This issue decodes exactly that.

We studied the investment approach of three leading Indian VCs—Blume Ventures, Lightspeed India, and Together Fund—to understand how they identify opportunities, structure deals, model outcomes, and plan exits in the AI space.

This isn’t theory.

This is the strategy behind the cheque.

🔍 Benchmark Study: 3 VCs, 3 Strategies, 1 Future

We evaluated each VC’s approach across:

Sector Focus

Investment Triggers

Evaluation Framework

Business Model Preference

Moat Identification

Exit Pathway Planning

Let’s break them down one by one 👇

🧬 1. Blume Ventures – Applied AI with India-First Execution

🧭 Thesis:

Blume doesn’t bet on foundational models. It focuses on applied AI—especially where physical world operations intersect with digital intelligence.

💸 Notable AI Investments:

Protex.ai (AI for workplace safety)

Kaarigar.ai (voice-AI workflows for Indian workers)

Beatoven.ai (AI-generated music)

🔎 Evaluation Strategy:

💼 Business Model Preference:

B2B SaaS or workflow automation with usage-based or license-based pricing.

Must show early signs of enterprise adoption, even in pilots.

🧮 Exit Logic:

Most likely through M&A or acquihire by legacy enterprises or global SaaS platforms.

Blume models a 3–5x return in 5 years, with higher upside only in rare network-effects cases.

🔗 2. Lightspeed India – Infra, Foundation, and Global Readiness

🧭 Thesis:

Lightspeed is one of the few Indian funds actively backing foundational AI plays. They believe India can not only build but scale infra and AGI-grade tech for global markets.

💸 Notable AI Investments:

Sarvam AI (India’s first open LLM)

Portkey.ai (developer infra for LLM routing)

Pixis (AI for growth automation)

🔎 Evaluation Strategy:

💼 Business Model Preference:

B2B SaaS (usage or infra) or PLG (developer-first)

Strong focus on API-first businesses that embed into dev workflows

🧮 Exit Logic:

Targeting global M&A or downstream growth rounds from US giants (Snowflake, OpenAI, AWS)

10–15x outcome modeled over 6–8 years if infra adoption crosses borders

⚙️ 3. Together Fund – AI-Native SaaS for Builders, by Builders

🧭 Thesis:

Together bets on AI-native SaaS: founders solving real productivity or compliance bottlenecks, often building for developers or operations-heavy teams.

💸 Notable AI Investments:

Supertokens (Auth infra with AI-edge)

Exponent (AI-powered engineering prep)

Multiple unannounced infra-backed SaaS startups

🔎 Evaluation Strategy:

💼 Business Model Preference:

SMB to mid-market SaaS with AI leverage, sold with minimal human sales touch

Fast ARR loops: land → expand → upsell

🧮 Exit Logic:

Mid-stage strategic M&A or Series B+ crossover investors

Looks for 5–10x outcomes with exit optionality across product ecosystems (e.g. Atlassian, GitLab, Notion)

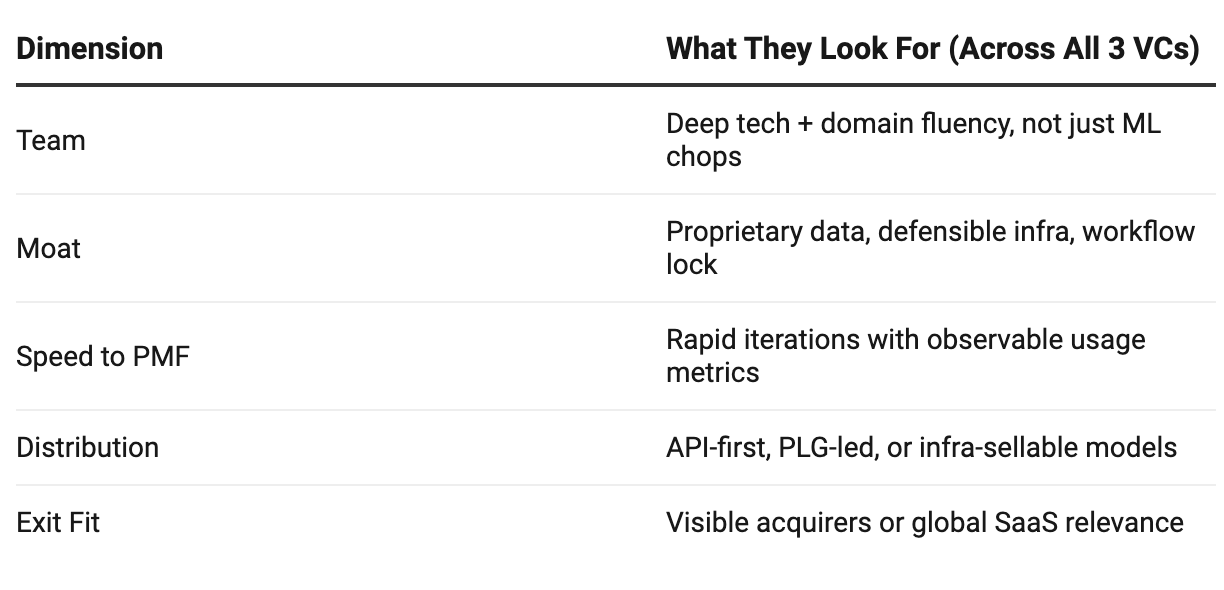

📐 Common Framework: What These VCs Measure in AI Startups

📈 Takeaway: Your Startup is a Model — They’re Running a Simulation

AI founders — understand this:

Investors aren’t just backing models.

They’re backing your ability to turn tech into distribution, distribution into retention, and retention into returns.

They have a framework.

Now you have it too.

See you in the next issue,

– Shubham Bopche

Founder, Venture Unlocked